It can also use it to reduce its paid-in capital balance. Companies can reduce their additional paid-in and paid-in capital balances to nil through a vertical merger.Ī vertical merger is a great way for a company to reduce its additional paid-in capital balance significantly. There are many advantages of disadvantages of vertical mergers for companies. In other words, a vertical merger is when a supplier and customer merge. A vertical merger is a merger between two participants of the same supply chain. In business terms, a merger is when two companies combine to group their resources to increase their market shares. However, a company must first adjust it against any balance in the additional paid-in capital balance and then take the remainder to the paid-in capital account.įor example, if a company has a total cash dividend of $20,000 but only has cash reserves of $15,000, it will cover the remaining $5,000 from the additional paid-in capital balance. Like stock buybacks, liquidating dividends also affect the paid-in capital balance.

Usually, liquidating dividends are rare in companies but can still decrease the additional paid-in and the paid-in capital balances of a company. In both scenarios, the company must liquidate its funds in its reserves to pay its shareholders. See also Equity Finance – 4 Advantages and 4 Disadvantages These are known as liquidating dividends. In both these cases, the company must pay its shareholders from its reserves. Sometimes, companies may also not have enough cash to cover the issue of a dividend-paying stock.

#Additional paid in capital full#

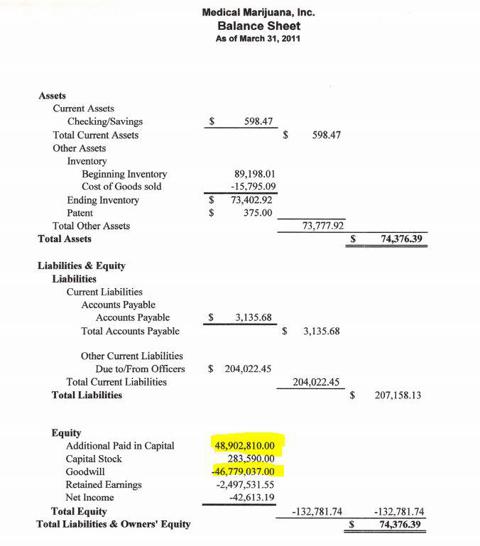

2) Liquidating Dividendsĭuring a partial or full liquidation, companies must make payments to their shareholders. However, the company won’t usually buy enough shares to affect its paid-in capital account as well. However, if the value of the shares rebought is above the balance in the additional paid-in capital balance, then the company can also utilize its paid-in capital balance. For example, a company can use tender offers to buy back shares or buy its shares from the stock market directly.Īs mentioned above, the additional paid-in capital balance will reduce due to stock buybacks. Stock buybacks work in many different ways. On the other hand, the company also decreases its reserves for the value of the shares it repurchased. In a stock buyback, a company pays its shareholders cash in exchange for their shares. It is also a way for companies to return wealth to their shareholders without paying them dividends or through stock appreciation. 1) Stock BuybacksĪ stock buyback is a process used by a company to buy back shares from the market. The conditions that result in a reduction in the additional paid-in capital balance of a company are the following. Usually, any reduction in the paid-in capital account will first affect the additional paid-in capital account. Therefore, a company cannot use the account unless needed in specific conditions. See also Capitalization of the Retained Earnings: Detail Explanation Reducing Additional Paid-in Capital:Ī reduction in the additional paid-in capital account is very rare. In the example above, the par value of the share is $100, and the actual price the company receives is $150. When a company receives compensation for shares above their par value, the excess amount is known as additional paid-in capital. For the company, while $150 is capital, it must split it into two portions.

However, due to several factors, the actual price that shareholders pay for it might be different from its par value.įor example, the par value of a share may be $100, but shareholders may be willing to pay $150 for it.

Every share has a par value, which is the predetermined value of that share. When a company issues its shares, it will receive compensation from the shareholders who buy the share.

Any subsequent transactions related to those shares do not affect the accounts or finance of the company. A company only receives compensation for its shares when it issues the shares initially. Therefore, the price usually depends on the stock market. The price of the share is usually the price that market participants are willing to pay for it. The shareholders receive shares of the company in exchange for the shares of the company. The main source of finance for a company is the equity investment it receives from its shareholders.

0 kommentar(er)

0 kommentar(er)